- Blue Cross Blue Shield Copay And Deductible 2020

- Blue Cross Blue Shield Copay And Deductible Plans

- How Much Is The Deductible For Blue Cross Blue Shield

- What Is The Deductible For Blue Cross Blue Shield

The chart below provides an at-a-glance overview of benefits under Standard Option.

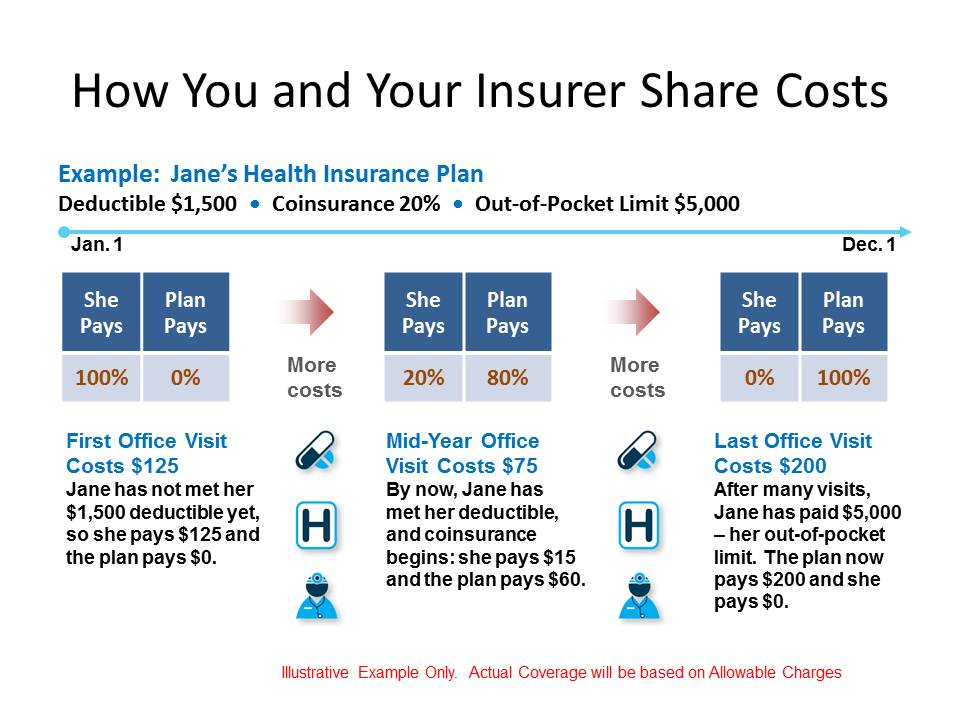

You only have to pay your deductible (if you have Standard Option or FEP Blue Focus), copay and/or your share of our allowance (known as coinsurance). $0 copay for epipen. This limits the amount you pay out of pocket. What does out-of-network mean? Non-preferred (out-of-network) providers do not agree to accept our allowance as payment in full for their services. Co-pay Option - Separate Medical and Prescription Drug Deductible.Services include certain Specialty Services which are Ambulatory Services performed in a non-hospital setting approved and designated by Blue Cross & Blue Shield of Mississippi. Please fill out the form below and a Blue Cross and Blue Shield of Illinois authorized agent will contact you within 1 to 2 business days. They will schedule an appointment at a time and location that is convenient for you. Example #1: Deductibles, Coinsurance and Out-of-pocket maximum. Your health plan has a: $4,000 deductible; 25%.

Enroll in Standard Option App Store is a service mark of Apple Inc., registered in the U.S. and other countries.'>CORONAVIRUS UPDATE: FEP will waive any copays or deductibles for medically necessary diagnostic tests or treatment that are consistent with CDC guidance if diagnosed with COVID-19. Learn more here.

Download the 2020 Blue Cross and Blue Shield Service Benefit Plan Standard and Basic Options brochure.

Not sure about a term or benefit listed below? Watch Health Insurance 101 for easy-to-understand definitions and explanations.

| Non-Postal Premium | Postal Premium | |||

|---|---|---|---|---|

| Bi-weekly | Monthly | Bi-weekly Category 1 | Bi-weekly Category 2 | |

| Self Only (104) | $116.91 | $253.30 | $113.63 | $103.81 |

| Self + 1 (106) | $267.15 | $578.83 | $260.15 | $239.14 |

| Self & Family (105) | $286.74 | $621.27 | $279.15 | $256.39 |

These rates do not apply to all enrollees. If you are in a special enrollment category, contact the agency or Tribal employer that manages your health benefits enrollment.

2020 Preventive Care

Preventive care is important at any age. It helps to identify any health concerns or conditions in the early stages of development, making them easier to treat. Any related complications may also be easier to treat.

| Services | Standard Option PPO Benefit – You Pay: | Standard Option Non-PPO Benefit* You Pay: |

|---|---|---|

Preventive care services for adults age 22 and older including the preventive services recommended by the U.S. Preventive Services Taskforce. Services include but are not limited to:

| Nothing for covered preventive screenings | 35% of our allowance for covered tests† |

Routine immunizations for adults age 22 and older [as licensed by the U.S. Food and Drug Administration (FDA)], limited to:

| Nothing for covered immunizations | 35% of our allowance† Note: Your deductible and coinsurance amount are waived for influenza vaccines billed by Participating and Non-participating providers |

| Preventive care services for children up to age 22, including preventive services recommended under the Affordable Care Act and the American Academy of Pediatrics. These services include but are not limited to visits or exams for preventive care, routine hearing and vision screenings, laboratory tests, immunizations, and nutritional counseling. | Nothing for covered services | 35% of our allowance† |

† Subject to the 2020 Standard Option calendar year deductible: $350 per person or $700 in total for Self Plus One or Self and Family contracts.

* If you use a Non-preferred provider under Standard Option, you generally pay any difference between our allowance and the billed amount, in addition to any share of our allowance shown in the table above. Certain out-of-pocket costs do not apply if Medicare is your primary coverage for medical services (it pays first).

2020 Professional Provider’s Care

The charts to the right provide an at-a-glance overview of your medical benefits under Standard Option.

| Services | Standard Option PPO Benefit – You Pay: | Standard Option Non-PPO Benefit* – You Pay: |

|---|---|---|

| Office visits and outpatient consultations | $25 office visit copay for primary care provider $35 office visit copay for specialist | 35% of our allowance† |

Routine exams and other preventive care services | Nothing for covered services | 35% of our allowance† |

Surgical care | 15% of our allowance† | 35% of our allowance† |

† Subject to the 2020 Standard Option calendar year deductible: $350 per person or $700 in total for Self Plus One or Self and Family contracts.

* If you use a Non-preferred provider under Standard Option, you generally pay any difference between our allowance and the billed amount, in addition to any share of our allowance shown in the table above. Certain out-of-pocket costs do not apply if Medicare is your primary coverage for medical services (it pays first).

2020 Pharmacy

If you have Standard Option, you may go to a local Preferred retail pharmacy, or order prescriptions through the Mail Service Pharmacy Program and Specialty Drug Pharmacy Program. Simatic prosave v10 youtube. You pay nothing for the first four generic prescription fills or refills when you switch from certain brand name drugs to specific generic drugs.

| Services | Standard Option PPO Benefit – You Pay: |

|---|---|

| Mail Service Pharmacy Program | Tier 1 (Generics): $15 copay* Tier 2 (Preferred brand): $90 copay Tier 3 (Non-preferred brand): $125 copay Covers a 22 to 90-day supply. Nothing for the first 4 prescription fills or refills when you switch from certain brand name drugs to specific generic drugs. |

| Retail Pharmacy Program | Tier 1 (Generics): $7.50 copay for up to a 30-day supply; $22.50 copay for a 31 to 90-day supply Tier 2 (Preferred brand): 30% of our allowance Tier 3 (Non-preferred brand): 50% of our allowance Tiers 1, 2 and 3 cover up to a 90-day supply. Nothing for the first 4 prescription fills or refills when you switch from certain brand name drugs to specific generic drugs when you use a Preferred retail pharmacy. Tier 4 (Preferred specialty drugs): 30% of our allowance Tier 5 (Non-preferred specialty drugs): 30% of our allowance Tier 4 and 5 specialty drugs are limited to a 30-day supply; only one fill allowed. All refills must be obtained from the Specialty Drug Pharmacy Program. |

| Specialty Drug Pharmacy Program | Tier 4 (Preferred specialty drugs): $50 copay for up to a 30-day supply; $140 copay for a 31 to 90-day supply Tier 5 (Non-preferred specialty drugs): $70 copay for up to a 30-day supply; $200 copay for a 31 to 90-day supply 90-day supply may only be obtained after third fill. |

*If you have Medicare primary, different cost share amounts may apply.

Malwarebytes for mac crack. On limited occasions, such as for certain drugs that require prior approval, you will need to file a claim for services received from Preferred providers.

2020 Accidental Injury/Medical Emergency

Under Standard Option, you pay nothing for the treatment of an accidental injury within 72 hours of the injury at any Preferred hospital emergency room, urgent care center or a physician or other healthcare professional’s office.

| Services | Standard Option PPO Benefit - You Pay: | Standard Option Non-PPO Benefit* – You Pay: |

|---|---|---|

| Accidental injury | Nothing for outpatient hospital and physician services within 72 hours | Nothing for covered services You may be responsible for any difference between our allowance and the billed amount |

| Medical emergency | 15% of our allowance† | 15% of our allowance† |

| Urgent care | $30 copay per visit | 35% of our allowance† |

† Subject to the 2020 Standard Option calendar year deductible: $350 per person or $700 in total for Self Plus One or Self and Family contracts.

2020 Mental Health and Substance Use Disorder

Under Standard Option, services for mental health and substance use disorder range from inpatient hospital/facility treatment to outpatient professional care. Payments vary based on the use of Preferred providers or Non-preferred providers.

| Services | Standard Option PPO Benefit - You Pay: | Standard Option Non-PPO Benefit* – You Pay: |

|---|---|---|

| Inpatient Hospital/Facility — Precertification is required | $350 per admission copay for unlimited days | Member facilities: $450 per admission copay for unlimited days, plus 35% of our allowance Non-member facilities: 35% of our allowance for unlimited days, and any remaining balance after our payment |

| Outpatient Hospital/Facility Care | 15% of our allowance† | 35% of our allowance† |

| Inpatient Professional Care | Nothing for covered professional visits | 35% of our allowance† |

| Outpatient Professional Care | $25 per visit copay | 35% of our allowance† |

† Subject to the 2020 Standard Option calendar year deductible: $350 per person or $700 in total for Self Plus One or Self and Family contracts.

* If you use a Non-preferred provider under Standard Option, you generally pay any difference between our allowance and the billed amount, in addition to any share of our allowance shown in the table above. Certain out-of-pocket costs do not apply if Medicare is your primary coverage for medical services (it pays first).

2020 Maternity Care

A variety of benefits are available for a healthy pregnancy - from prenatal to postpartum care.

| Services | Standard Option PPO Benefit - You Pay: | Standard Option Non-PPO Benefit* - You Pay: |

|---|---|---|

| Obstetrical care performed by a physician or nurse midwife, such as prenatal care (including ultrasound, lab and diagnostic tests), delivery, postpartum care | You pay nothing for delivery and pre- and postnatal care | 35% of our allowance† |

| Inpatient hospital Precertification is not required. Note: you may stay in the hospital for up to 48 hours after a regular delivery and 96 hours after a C-section. We will cover a longer stay if medically necessary; precertification is required for any inpatient stay beyond these time frames. | You pay nothing for delivery and pre- and postnatal care | $450 per admission copay for unlimited days, plus 35% of our allowance† |

| Outpatient facility care, including outpatient care at birthing facilities | You pay nothing for delivery and pre- and postnatal care | 35% of our allowance† |

Blue Cross Blue Shield Copay And Deductible 2020

† Subject to the 2020 Standard Option calendar year deductible: $350 per person or $700 in total for Self Plus One or Self and Family contracts.

* If you use a Non-preferred provider under Standard Option, you generally pay any difference between our allowance and the billed amount, in addition to any share of our allowance shown in the table above. Certain out-of-pocket costs do not apply if Medicare is your primary coverage for medical services (it pays first).

Blue Cross Blue Shield Copay And Deductible Plans

2020 Hospital/Facility Care

The charts to the right provide an at-a-glance overview of your hospital and facility care benefits under Standard Option.

| Services | Standard Option PPO Benefit – You Pay: | Standard Option Non-PPO Benefit* – You Pay: |

|---|---|---|

| Hospital Inpatient Precertification is required | Unlimited days $350 per admission copay | Unlimited days, $450 per admission copay, plus 35% of our allowance |

| Outpatient hospital / facility care | 15% of our allowance† | 35% of our allowance† |

† Subject to the 2020 Standard Option calendar year deductible: $350 per person or $700 in total for Self Plus One or Self and Family contracts.

* If you use a Non-preferred provider under Standard Option, you generally pay any difference between our allowance and the billed amount, in addition to any share of our allowance shown in the table above. Certain out-of-pocket costs do not apply if Medicare is your primary coverage for medical services (it pays first).

| Services | Standard Option PPO Benefit - You Pay: | Standard Option Non-PPO Benefit - You Pay: |

|---|---|---|

| Catastrophic Protection | 100% payment level begins after you pay $5,000 (Self Only) or $10,000 (Self Plus One or Self & Family) out-of-pocket in eligible coinsurance, copay and deductible expenses | 100% payment level begins after you pay $7,000 (Self Only) or $14,000 (Self Plus One or Self & Family) out-of-pocket in eligible coinsurance, copay and deductible expenses |

This is a summary of the features of the Blue Cross and Blue Shield Service Benefit Plan. Before making a final decision, please read the Plan’s federal brochure (RI 71-005). All benefits are subject to the definitions, limitations, and exclusions set forth in the federal brochure.

How Much Is The Deductible For Blue Cross Blue Shield

Enroll NowWhat Is The Deductible For Blue Cross Blue Shield

Thank You for Being a Caregiver